AG尊龙凯时 – AG尊龙官方网站

AG尊龙在2012年创立,是一家知名的博彩娱乐平台供应商,更是亚洲真人视讯游戏开发与供应领域的翘楚,其行业标杆地位备受认可。公司始终以“用户至上、专业为本”为核心理念,致力于打造公平、真实、专业的高品质沉浸式视讯体验,以满足广大玩家的需求。

每日更新的最新、畅通无阻的AG尊龙链接:https://hotelsikkimaurora.com/

AG尊龙 – 在线博彩娱乐的简介

由M.A.N Entertainment集团所创立的AG尊龙,是一个杰出的博彩娱乐品牌,在中国及亚洲地区获得了普遍的关注。自进入市场以来,该品牌已持有菲律宾政府核准的合法运营牌照,并通过了亚洲博彩娱乐监管委员会(NCGAC)的安全游戏认证,从而确保了玩家能够享受到安全且值得信赖的娱乐服务。

通过提供一系列丰富且顶级的在线娱乐游戏,AG尊龙稳固占据着行业前沿位置。平台为会员整合了多元选择与丰富的游戏功能,致力于迎合不同玩家的口味。AG尊龙全心投入到为用户打造奢华、独特娱乐空间的事业中,提供优质游戏体验,并为玩家创造丰厚回报,确保每个人都能体验到超值的收益。

AG尊龙 – 全亚洲最受信赖的博彩品牌

面对在线博彩市场的激烈角逐,AG尊龙依靠其卓越的竞争力脱颖而出,并快速成为亚洲区域内备受信任与广泛好评的娱乐场所。接下来将为您展现AG尊龙那些与众不同的核心魅力:

AG尊龙 – 简洁与独特并存的用户界面设计

AG尊龙网站以简洁直观的界面设计为特色,致力于提供流畅便捷的用户体验。合理的色彩搭配与精心设计的布局,彰显了顶级在线娱乐平台的专业水准。促销活动和游戏目录清晰明了,信息一目了然,让新手玩家无需额外指导,便能轻松上手,享受无缝衔接的娱乐体验。

AG尊龙 – 全面保障安全与隐私,尽享无忧娱乐体验

玩家在选择在线娱乐平台时,最优先考虑的无疑是身份与数据的安全保障。AG尊龙洞察这一需求,投入巨资采用顶级安全技术体系,致力于为用户隐私和数据提供全面庇护。通过加密技术与多重防护措施的结合,平台确保所有个人信息和账户数据安然无恙。

优质游戏与透明奖励,尽享公正与乐趣

凭借汇聚全球顶级游戏供应商的精华,AG尊龙的游戏库内容丰富多元,且每款游戏均经过严格的准入审核与多轮测试,以保证其公平与优质。平台确保玩家奖金快速到账,操作规范无任何违规,全力保障全体会员的合法权益。

AG尊龙移动应用,畅享无缝娱乐体验

在网页版获得成功的同时,AG尊龙已将同样卓越的娱乐体验移植到移动端。我们的手机应用深受行业专家推崇和玩家欢迎。安装步骤极其简单,助力玩家随时随地畅玩;应用小巧、下载即时,保证游戏过程丝滑流畅且连接稳定,提供无可挑剔的娱乐享受。

AG尊龙 – 高效交易处理,畅享无缝娱乐体验

AG尊龙凭借其领先的交易处理系统,赢得了广大玩家的喜爱。平台支持多种充值和提款方式,如银行转账、充值卡和电子钱包等,满足不同玩家的需求。交易速度经过精心优化,玩家通常能够在几分钟内收到交易完成通知,确保资金流转迅速、无缝衔接。

AG尊龙 – 24/7 全天候会员支持,随时为您服务

为了保障玩家体验,AG尊龙会对任何疑问或突发问题做出及时且周全的处理。我们的客服支持全天候运行,全年无休。由一群年轻、专业、热情的成员组成的团队,凭借累积十年的行业经验,能够迅速提供高效解决方案,确保玩家娱乐过程毫无后顾之忧。

AG尊龙游戏

AG尊龙游戏提供丰富多样的娱乐选择,满足不同玩家的需求。平台涵盖了多个游戏类别,包括:

AG尊龙体育

AG尊龙是您追求卓越体育投注体验的绝佳平台,其多样化的投注选择让每位玩家均可找到专属乐趣。我们全面支持您的各类投注偏好,并助您实时追踪比赛动态。平台包含让球、大小、波胆及总入球等众多投注类型,提供覆盖各大赛事的全球最高赔率。借助高清动画与实时视频直播,您可随时观看比赛并体验即刻投注的刺激。AG尊龙通过持续的服务升级,全力为您打造无与伦比的投注体验。

AG尊龙真人

投身于AG尊龙的真人视讯游戏,开启一段无与伦比的沉浸式娱乐之旅!我们提供涵盖百家乐、骰宝、轮盘、牛牛、炸金花等多款热门游戏的荷官互动服务,带您感受真人视讯世界的无限激情与精彩。平台坚持官方直营,并严格遵循国际准则,确保所有游戏环节的公平公正。您不仅能体验到高清画面和顺畅操作,还能享受与真人荷官实时互动的乐趣,收获前所未有的娱乐体验。凭借公正、信任和优质服务,AG尊龙成功赢得了广大用户的衷心喜爱与支持。

AG尊龙电竞

AG尊龙为您打造全新电竞竞猜旅程,创新的自由串关与即时滚球功能,让竞猜时刻充满欢愉。注单秒级确认,热门赛事快速结算,确保您能专注每一场激动人心的对决。平台包罗全球顶尖电竞赛事,每月带来数百场比赛和海量盘口选择,提供多样投注机会。直观界面结合顺畅操作,让投注轻松简单,赛事体验更加沉浸。作为顶级电竞赛事平台的伙伴,AG尊龙与行业先锋赛事携手合作,提供最新竞猜、视频及资讯,助您始终紧跟电竞趋势,尽情探索电竞独特韵味。

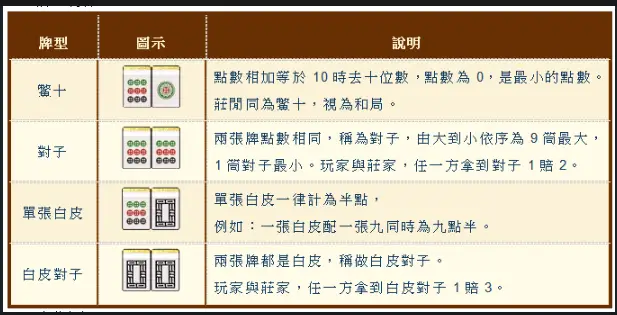

AG尊龙彩票

通过推出创新、便捷的多样玩法,AG尊龙正引领彩票新趋势,带来前所未有的互动享受。平台提供即时连线开奖,涵盖最全面的彩种,由此开启彩票新纪元,逾百种玩法邀您挑战!我们致力于向全球玩家提供丰富且高质的游戏选项,并确保每注彩票开奖的公平与公正性,让玩家安心娱乐。无论是多元的彩种、坚实的奖池,还是极速的开奖节奏,AG尊龙都旨在为您提供顶尖的购彩感受,帮您更高效地获取奖励。

AG尊龙棋牌

AG尊龙始终将安全放在首位,凭借欧洲顶级安全认证,为玩家提供无忧的游戏体验。平台汇聚多款热门棋牌游戏,如抢庄牛牛、龙虎斗等,每一款都充满刺激与乐趣,带来无限挑战。我们不仅注重游戏画质和流畅度,还提供丰富的游戏选择,确保玩家始终保持兴奋与激情。与此同时,严密的安全保障和监管体系,确保每一场游戏都公正透明,玩家的安全得到充分保障。加入AG尊龙,与朋友一起竞技,享受前所未有的娱乐魅力!

AG尊龙电子

AG尊龙汇聚了AG捕鱼、PG电子等行业内领先的游戏供应商,致力于为玩家提供最火爆、最优质的游戏体验。我们与多家知名厂商合力打造了一个高标准的电子游艺平台,囊括百余款精品游戏,全面覆盖玩家的各类兴趣。在平台上,经典老虎机、刮刮乐、棋牌、街机等多样化娱乐任您选择。不仅如此,丰富的免费游戏和丰厚的爆分大奖也已就绪,邀请您一同挑战,尽享极致的娱乐乐趣与心跳刺激!

赛事覆盖全面

MORE EVENTS TO PLAY

AG尊龙每日更新超500场精彩赛事,涵盖全球各大热门体育类别。无论是足球、篮球、网球或棒球等项目,我们都为您精心准备最全面、最激动人心的游戏体验。使您随时随地都能畅享多元体育赛事,沉浸于每场竞赛的激情与挑战之中。

90秒极速出款

LESS 90 SEC TRANSFER

除了网页版的杰出表现,AG尊龙在移动端同样取得了显著成功。我们的手机应用收获了来自专家和玩家的高度评价。简便的安装让玩家可随时参与娱乐;应用设计轻量、下载迅速,且运行极其流畅,杜绝卡顿与掉线,提供一流的移动娱乐服务。

三端任您选择

MORE DEVICES ACCOUNT

AG尊龙致力于提供全终端兼容体验,支持PC与移动端无缝互联。通过原生APP,投注轻松易行,让您无论身处何处,都能享受流畅且方便的游戏时光。

信誉资金托管

MORE WAYS TO PROTECT

AG尊龙自主研发的安全技术,采用128位加密技术,并结合严格的安全管理体系,全面保障客户资金的安全。我们致力于为您提供最强大的保护,让您无忧享受每一场游戏的乐趣。

客户常见问题

您可以通过官方网站或APP进行注册。点击“注册”按钮,填写相关信息并完成验证,即可成功创建账户。

在平台登录后,进入“我的账户”页面,选择“存款”,根据您的需求选择支付方式(如银行转账、电子钱包等),按提示完成存款操作。

登录账户后,进入“我的账户”页面,选择“提款”,输入提款金额和选择支付方式,按提示完成身份验证,等待资金到账。

平台支持包括银行转账、电子钱包和充值卡在内的多种支付渠道,确保您的资金存取方便而高效。

AG尊龙以128位加密技术为核心,辅以严格的安全管理措施,确保您的账户信息和资金始终安全无忧。

是的,AG尊龙提供专为移动设备设计的APP,兼容iOS和Android系统,您可以随时随地畅享游戏。

一旦出现技术问题,请随时联系我们的24小时在线客服,我们会迅速响应并为您提供所需帮助。

在平台上选择您感兴趣的活动或赛事,点击进入后根据提示进行投注,系统会实时更新您的投注信息。

AG尊龙致力于满足所有玩家的需求,因此提供了体育博彩、真人视讯、棋牌游戏、电子游艺和彩票等一系列丰富的游戏。

您可以通过平台提供的在线聊天工具、客服电话或电子邮件联系我们的客服团队,我们将为您提供全天候的服务。

结论

通过以上内容的分享,您能更深刻地体会到AG尊龙作为一个充满吸引力的平台,其提供的独特投注娱乐和丰富促销活动。AG尊龙深受中国玩家欢迎,每日都有数以千计的玩家积极参与。现在,您只需访问链接 https://hotelsikkimaurora.com/ 就能轻松成为AG尊龙的会员,开启精彩之旅!务必把握这个绝好机会,立即探索令人兴奋的游戏与丰厚奖励,畅享无与伦比的娱乐感受!